Paying My Bills

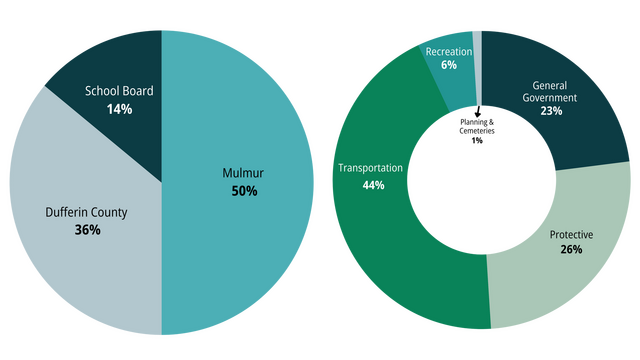

Taxes provide the main source of revenue to deliver services supplied by the Township, the County of Dufferin and School Boards. Annual tax rates are set and applied to each tax class. The tax levy is then calculated by applying the tax rate to the assessed value of the property.![]()

2026 tax due dates are:

- February 18

- May 20

- August 26

- October 21

E-Billing:

Sign up for e-billing for your taxes and utilities accounts online using the button below, or by completing the sign up form. E-billing sign up forms can be emailed to taxes@mulmur.ca , or mailed to our office at 758070 2nd Line East, Mulmur, ON L9V 0G9.

Payment Options:

Payments may be paid with cash, cheque, debit card, online banking, and pre-authorized payment (PAP) (for taxes and water only).

Credit card payments are only accepted online through Paymentus. Please see below for more information.

We do not accept credit cards at the Municipal Office or over the phone.

Online Banking Payment Instructions

To pay with online banking

- Log into your personal bank account.

- Select add a payee

- Search for "Mulmur"

- Select the tax option

- Use your 19-digit tax roll number (no spaces or dashes)

To pay water and other bills (not taxes):

- Follow steps 1 to 3 above.

- Select the utility/accounts receivable (AR) option,

- Use your 5-digit account number.

Pre-authorized Payments (PAP)

To sign up for PAP, complete the application forms below. Please note to register for the PAP program your account must be in good standing.

Mulmur Tax PAP Application Form

Mulmur Water PAP Application Form

Payment by Debit or Credit Card

- Payments can be made with a debit card at the Municipal Office.

- We do not accept credit cards at the Municipal Office or over the phone.

- PAYMENTUS is a secure processing service which allows you to use your credit card or debit card to pay your property taxes, water bills or other bills.

- Be advised that PAYMENTUS will charge you a service fee of 2.5% on the total amount of your transaction for credit card payments and 1.5% for debit card payments. For example, a $1,000 payment by credit card will cost you an extra $25.00 in PAYMENTUS service fees.

- Visit PAYMENTUS to make a payment online or call them at 1-888-647-0211 to pay over the phone.

- Click here to make an online credit card or debit card payment via the PAYMENTUS processing service.

Tax Certificates:

A tax certificate is a legal document that shows the annual property taxes and any current or prior arrears for a property. Tax certificates are typically requested by a lawyer during a property transfer or purchase.

Requesting a Tax Certificate:

To request a tax certificate, please complete a Tax Certificate Request Form. Request forms can be dropped off to our office or mail to at:

Township of Mulmur

758070 2nd Line East

Mulmur, ON L9V 0G9

We will do our best to process your request within five business days.

Fees:

The fee for a tax certificate is $80.00 per request. Please ensure all cheques are made payable to the Township of Mulmur.

Penalties:

Payment in full must be received by the Township Office by the due date to avoid interest and penalty charges. A charge of 1.25% calculated on all outstanding amounts will be applied on the first day of each calendar month there after. The Township is not responsible for mail or banking delays.

Failure to receive your tax notice does not relieve the taxpayer from payment nor from liability of penalty for late payment. lt is the owner's responsibility to notify the Township of any changes to their account.

NSF charges will apply to dishonoured payments and will be collected in the same manner as taxes.

It is the owner's responsibility to forward tax bills to a bank, insurance, or mortgage company if taxes are to be paid by the mortgagee.

The tax collector has no authority to waive or alter penalty and/or interest for any reason.

MPAC and Property Assessments:

Taxes provide the main source of revenue to deliver services supplied by the Township, the County of Dufferin and School Boards. Annual tax rates are set and applied to each tax class. The tax levy is then calculated by applying the tax rate to the assessed value of the property.

The Municipal Property Assessment Corporation, also know as MPAC assesses and classifies every property in Ontario under the Assessment Act, and regulations established by the Provincial Government. The assessed value of your property is used as the basis for calculating your property taxes.

For information or inquiries about your property's assessment or how MPAC assesses properties, you may contact their customer service at 1-866-296-6722 visit their website here. You can also view their "Property Assessment and Taxation Toolkit for more information.

An assessment increase does not necessarily mean that your property taxes will increase. If you feel your assessed value or property classification is not correct, the deadline to file for a Request for Reconsideration (RfR) or an Appeal is March 31 of the tax year.

Tax Rates:

To calculate the total taxes: Assessment value x applicable tax rate = Total Taxes

Section 357 (1) of the Municipal Act

Upon application to the Treasurer, in accordance with this section, the local Township may cancel, reduce or refund all or part of the taxes levied on land in the year in respect of which the application is made.

There are various reasons for tax adjustments under Section 354, 357, 358 and 359 such as property becoming exempt, roll numbers being cancelled by MPAC, buildings that have been demolished or razed by fire or demolition and properties that have been over-assessed by a gross or manifest clerical error. These tax adjustments do not relate to collection issues.

The Municipal Property Assessment Corporation (MPAC) assists with processing municipal tax applications by providing municipalities with the information they need to help Council determine whether a refund, cancellation, reduction, or increase is warranted.

Tax Relief Low Income Seniors & Low Income Persons with Disabilities

The Council of the Corporation of the County of Dufferin has passed a by-law providing for relief of property tax increases on property in the residential/farm property class for owners (or spouses or same-sex partners of owners) who are low-income seniors or low-income persons with disabilities.

You MUST apply before November 30 of the year in which the property tax increase relates.